Apollo Silver (TSX.V: APGO): The Next $10 Silver Breakout

By Gekko vs Wolf Editorial Team — May 1, 2025 · 8 min read

Apollo Silver (TSX.V: APGO): The Next $10 Silver Breakout

By Gekko vs Wolf Editorial Team — May 1, 2025 · 8 min read

INTRODUCTION: SILVER’S COMEBACK AND A COMPANY PRIMED TO SURGE

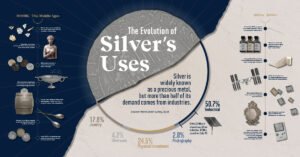

Silver has re-entered the global investment spotlight — and for good reason. With inflationary pressure, fiscal expansion, and record industrial demand across solar, EVs, and infrastructure, the silver market is at the start of what could be a historic bull cycle. And in every cycle, certain companies emerge as breakout winners. One of the most compelling bets in the sector right now? Apollo Silver Corp. (TSX.V: APGO).

Apollo isn’t just another junior explorer — it’s a company with scale, strategic positioning, a proven leadership team, and massive re-rating potential. With over 166 million ounces of silver in the ground, strong institutional support, and a tight capital structure, Apollo is the kind of silver vehicle that could go from 30 cents to $10/share if silver prices move and investors return to the space.

COMPANY SNAPSHOT: WHY APOLLO STANDS OUT

-

Ticker: TSX.V: APGO

-

Market Cap: ~$86M CAD

-

Flagship Project: Calico (California, USA)

-

Resource Size: 166 Moz Ag (M&I)

-

Cash Position (2025): $13.5M

-

New Project: Cinco de Mayo (Mexico)

Apollo is laser-focused on developing one of the largest undeveloped silver resources in the United States, while adding blue-sky potential via its new acquisition in Mexico.

THE CALICO PROJECT: SILVER SCALE IN CALIFORNIA

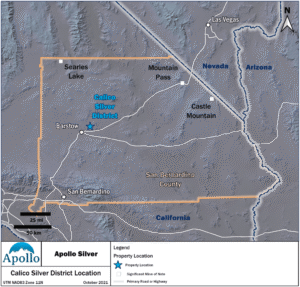

Calico, located in San Bernardino County, California, includes two historical assets — Waterloo and Langtry — that together host 166 Moz of Measured & Indicated silver resources.

Location Advantages:

-

Near highways, rail, water, and power

-

Low elevation, year-round access

-

Surrounded by past-producing mines

Apollo controls 100% of Waterloo and has an option on Langtry, effectively consolidating an entire silver district.

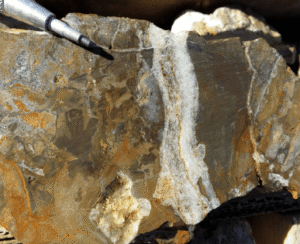

Geology & Mineralization:

-

Near-surface, oxide-dominant silver

-

Hosted in volcanics — amenable to open-pit mining

-

Thick, consistent intercepts with strong continuity

Drilling has confirmed widespread mineralization, and metallurgical testing is underway to optimize recovery methods.

STRATEGIC EXPANSION: CINCO DE MAYO IN MEXICO

In 2024, Apollo made a bold move by acquiring the Cinco de Mayo Project in Mexico — one of the country’s most promising undeveloped silver-lead-zinc properties. Located in northern Chihuahua, Cinco sits within a belt that hosts deposits like Platosa and Santa Eulalia.

Cinco is early-stage but offers:

-

Large-scale carbonate replacement system (CRD) potential

-

High-grade historical intercepts

-

Room to define multiple zones over a 5 km trend

With Calico providing scale and Cinco offering growth, Apollo is positioning itself as a multi-asset North American silver growth story.

MANAGEMENT: BACKED BY THE RIGHT TEAM

Apollo is led by Andrew Bowering, one of the most successful capital markets operators in Canadian mining over the last decade. Bowering’s career includes over $500M raised and direct involvement in two of the biggest junior resource wins of the 2020s:

1. American Lithium (TSX.V: LI)

-

Started: $0.125 in Jan 2020

-

Peaked: $6.25 in Nov 2021

-

Gain: 4,900%

2. Prime Mining (TSX.V: PRYM)

-

Started: $0.29 in Jan 2020

-

Peaked: $5.00 in late 2021

-

Gain: 1,624%

His involvement in Apollo, combined with the support of institutional heavyweight Eric Sprott, signals that serious capital sees serious upside.

SILVER MARKET OUTLOOK: PERFECT STORM BREWING

Silver has always been volatile — but in the current macro setup, the upside potential is enormous:

-

Monetary Demand: Silver remains a hedge against fiat currency debasement

-

Industrial Demand: Solar, EVs, semiconductors, and 5G are all silver-intensive

-

Supply Risk: Declining grades, few new discoveries, geopolitical uncertainty

-

Energy Transition: Silver is essential in renewable technologies

Analysts from BMO to UBS are raising silver price forecasts. With a breakout above $30/oz silver, junior developers like Apollo could see massive re-ratings.

FINANCIAL STRENGTH: WELL-CAPITALIZED TO DELIVER

Apollo raised $13.5M CAD in Q1 2025, with Sprott as a lead investor. This capital will fund:

-

Phase 2 drilling at Calico

-

Metallurgical testing

-

Updated economic studies (PEA)

-

Exploration at Cinco de Mayo

Apollo also maintains a tight share structure, giving it more leverage per dollar than peers with bloated floats.

VALUATION SNAPSHOT: THE $10 TARGET CASE

Apollo trades at ~$0.52/oz silver in the ground, while historic acquisition multiples are often $1.50–$3.00/oz.

At $2.00/oz:

166M oz imes $2.00 = $332M USD = ~$450M CAD

Implied Share Price: ~$1.80–$2.00 CAD

At $10/share target: Market cap = ~$2.3B CAD

Still below where Prime Mining and American Lithium peaked in similar macro environments.

COMPARABLES: WHERE APOLLO SITS IN THE LANDSCAPE

| Company | Market Cap (CAD) | Resource Size (Ag) | Price/oz | Jurisdiction |

|---|---|---|---|---|

| Apollo Silver | ~$86M | 166 Moz (M&I) | $0.52 | USA/Mexico |

| Bear Creek Mining | ~$140M | 124 Moz | $1.13 | Peru |

| Discovery Silver | ~$290M | 330 Moz | $0.88 | Mexico |

Apollo is significantly undervalued vs peers on a silver/oz basis.

TIMING CATALYSTS: WHAT’S COMING NEXT

-

Calico Phase 2 drill results (Q2 2025)

-

Updated PEA + metallurgy (H2 2025)

-

Cinco de Mayo initial exploration program

-

Rising silver prices (macro tailwind)

-

Institutional buying as resource sentiment returns

CONCLUSION: APOLLO SILVER IS BUILT FOR THIS MOMENT

The silver market is primed for upside, and few companies offer the blend of:

-

Resource scale

-

Institutional backing

-

Leadership pedigree

-

Portfolio diversification

…that Apollo Silver delivers.

At 35 cents, it’s a sleeper. At $10, it’ll be the stock people wish they bought.

For those looking to front-run the next junior silver breakout, Apollo (TSX.V: APGO) is a name you can’t afford to ignore.

Disclosure Statement

This article contains forward-looking statements regarding the company featured. These statements are based on current expectations and assumptions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied. Readers are cautioned not to place undue reliance on forward-looking statements.

Neither the author nor GEKKOvsWOLF has any business relationship with the company featured in this article. No compensation has been received for the creation, publication, or distribution of this content. This article reflects the personal opinions of the author and is provided for informational purposes only. It does not constitute financial, investment, or legal advice.

Readers are strongly encouraged to perform their own due diligence and consult with a licensed financial advisor before making any investment decisions. Investing in junior resource companies or crypto-related projects involves significant risks, including the potential loss of principal. For comprehensive and up-to-date information, refer to the company’s public filings on SEDAR+, OTC Markets, EDGAR, and other official disclosure sources.