The Next Big Copper Find? Giant Mining’s Nevada Bet Is Dirt Cheap

Imagine a junior mining company sitting on a massive copper-silver-gold deposit in the heart of Nevada, one of the world’s top mining jurisdictions. Now picture it using cutting-edge AI to unlock that deposit’s potential, all while trading at a fraction of its peers’ valuations. This isn’t a fantasy—it’s Giant Mining Corp. (CSE: BFG | OTC: BFGFF | FWB: YW5), a $13.4M CAD market cap explorer poised for a breakout as its flagship Majuba Hill project delivers results and the copper and gold markets heat up. With drilling underway, a gold asset adding upside, and a macro backdrop screaming opportunity, Giant Mining is the kind of high-potential, undervalued stock that savvy investors dream of discovering.

Why Copper and Gold Are the Place to Be

The world is electrifying, and copper is the metal powering that transformation. Electric vehicles (EVs) require 183 lbs of copper each, while grid-scale renewable energy projects are copper-hungry beasts. Experts forecast copper demand will double by 2035, but new discoveries are dwindling, and mine grades are declining. This supply-demand crunch is a ticking time bomb for copper prices—and a golden opportunity for explorers like Giant Mining.

Gold, meanwhile, is shining near $2,400–$2,500/oz, fueled by inflation fears, geopolitical tensions, and central bank buying. Investors are flocking to gold as a safe haven, and junior miners with proven gold assets are reaping the rewards. Giant Mining checks both boxes: a copper-silver-gold porphyry in Nevada and a high-grade gold project in Idaho, positioning it to ride these twin bull markets.

Nevada, ranked #1 globally in the Fraser Institute’s 2022 Mining Survey, adds a critical edge. Unlike riskier jurisdictions, Nevada offers stability, infrastructure, and investor confidence, making Giant’s assets even more attractive to majors looking for tier-1 projects.

Giant Mining: A Snapshot of Opportunity

Giant Mining Corp. is a junior explorer with two high-potential assets: the Majuba Hill Porphyry Copper-Silver-Gold Project in Nevada and a 20% carried interest in the Friday Gold Project in Idaho. At a share price of $0.18 CAD and a market cap of just $13.4M CAD, Giant is a steal compared to peers trading at 2–7x its valuation. With 74.7M shares outstanding and a fully diluted count of 116.1M, the company is tightly structured for significant upside as exploration milestones hit.

CEO David Greenway sums it up: “With the growing demand for domestic U.S. copper, the timing couldn’t be better. Our team has never been more confident in advancing Majuba Hill’s full potential.” Fully financed for its 2025 drilling campaign, Giant is charging toward catalysts that could send its stock soaring.

Majuba Hill: A Copper-Silver-Gold Powerhouse

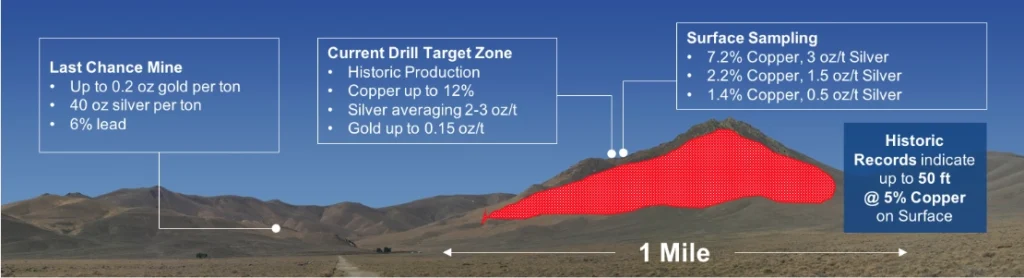

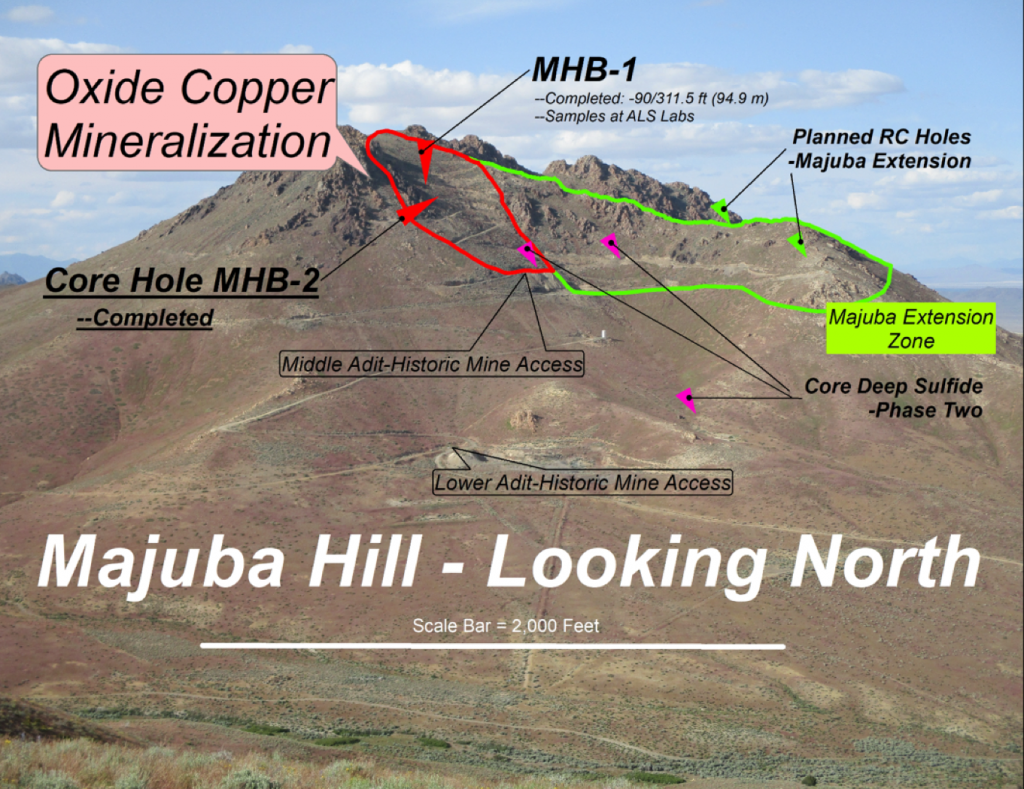

The Majuba Hill Project, located 70 miles southwest of Winnemucca, Nevada, is Giant’s crown jewel. Spanning 9,684 acres of unpatented and patented claims plus private land, this project is a geological treasure chest. Historically, it produced 2.8M lbs of copper, 184,000 oz of silver, 5,800 oz of gold, and 21,000 lbs of tin, proving its mineral richness. Today, Giant is unlocking a potentially massive porphyry copper system with surface oxide copper, deeper sulfide feeders, and hydrothermal breccias—hallmarks of world-class deposits.

Drilling into the Future

The 2025 drilling program is in full swing, and the results are tantalizing. Here’s what’s happening:

- MHB-32: Intersected breccia zones with visible azurite and malachite, classic copper indicators.

- MHB-33: Drilled to 936 ft, showing signs of native copper and chalcopyrite.

- MHB-34: Surpassed 1,600 ft, still exploring deeper zones.

- MHB-36: The fifth hole, targeting a high-potential southern anomaly identified by AI, is underway at a planned depth of 1,000 ft.

These holes build on 83,930 ft of drilling to date, worth an estimated $10.4M USD in development costs. Samples are being logged in Elko, Nevada, and sent to ALS Labs for assays, with results expected to provide near-term catalysts. The goal? Expand known copper mineralization and advance toward a maiden Mineral Resource Estimate (MRE), a milestone that could re-rate Giant’s valuation overnight.

AI-Powered Exploration

What sets Giant apart is its use of ExploreTech’s AI platform, a game-changer in mineral exploration. By integrating geophysical data (resistivity, magnetics), historic drill logs, and trenching, ExploreTech’s Engine AI tested thousands of models to pinpoint high-potential targets, like the southern anomaly now being drilled. Tyler Hall, President of ExploreTech, explains: “This approach improves drilling efficiency and allows continuous refinement as new data comes in.” In a sector where precision is everything, Giant’s AI edge maximizes its chances of a major discovery.

Infrastructure and Expandability

Majuba Hill’s location is a logistical dream. Just 23 miles from Interstate 80, the project boasts access roads, powerlines, water, and historic heap leach pads, slashing future development costs compared to remote projects. Geophysical surveys and step-out drilling suggest mineralization is open in all directions, hinting at a deposit far larger than current data reflects. With copper prices climbing and majors hunting for scalable assets, Majuba Hill is a prime takeover target.

Friday Gold: A High-Grade Bonus

While Majuba Hill steals the spotlight, Giant’s 20% carried interest in the Friday Gold Project in Idaho’s Orogrande Shear Zone adds significant upside. A 2013 NI 43-101 report outlined 647,000 oz of indicated gold (1.0 g/t) and 590,000 oz of inferred gold (0.88 g/t), with historic grades as high as 447.81 g/t Au. With 93% recovery via cyanidation, this project is a low-risk, high-reward asset operated by Premium Exploration. As gold prices hover near all-time highs, Friday Gold enhances Giant’s portfolio, offering diversification and additional value.

Stacked Against Peers: Giant’s Undervaluation

Giant Mining’s $13.4M CAD market cap is a fraction of its peers, making it one of the most undervalued juniors in the copper space. Consider these comparables:

- Faraday Copper: $90M CAD (Arizona, advanced exploration)

- Libero Copper: $25M CAD (BC/Colombia, inactive)

- Kodiak Copper: $38M CAD (British Columbia, drilling paused)

- Desert Mountain: $45M CAD (USA, helium exploration)

Peer valuations imply an enterprise value per pound of in-situ copper equivalent (EV/lb CuEq) of $0.03–$0.08/lb. Giant, with no official resource yet, trades at an estimated < $0.01/lb CuEq—a screaming bargain. If Majuba Hill’s drilling confirms a modest resource and Giant’s valuation aligns with peers at $0.03/lb, its market cap could jump to $40–50M CAD, a 3–4x return from current levels. A larger discovery or takeover bid could push returns even higher.

Catalysts to Watch

Giant Mining is at a pivotal moment, with multiple catalysts on the horizon:

- Assay Results: Results from MHB-32, MHB-33, MHB-34, and MHB-36 could confirm high-grade copper, silver, or gold, driving share price spikes.

- Maiden MRE: A resource estimate for Majuba Hill would provide a concrete valuation benchmark, likely triggering a re-rating.

- Copper and Gold Prices: Rising commodity prices will amplify investor interest in quality juniors like Giant.

- Takeover Potential: Majors like Freeport-McMoRan or Barrick, hungry for tier-1 copper and gold assets, may eye Majuba Hill as a strategic acquisition.

Risks: Eyes Wide Open

Junior mining isn’t for the faint of heart. Exploration is inherently uncertain, and while Majuba Hill’s historic production and AI-driven drilling boost confidence, there’s no guarantee of a major discovery. The 38.2M warrants and 2.4M RSUs could lead to dilution if exercised, though the current share price suggests limited near-term pressure. Commodity price volatility is another factor, but the long-term outlook for copper and gold remains bullish. For risk-tolerant investors, Giant’s asymmetric upside far outweighs these challenges.

Why You Should Consider Acting Now

Giant Mining Corp. is a rare opportunity: a grossly undervalued junior miner with a world-class copper-silver-gold project, a high-grade gold asset, and a technological edge, all in a top-tier jurisdiction. At $0.27 CAD per share, it’s trading at a fraction of its potential, with drilling results and a maiden MRE poised to unlock value. The copper and gold markets are screaming for new supply, and Giant is perfectly positioned to deliver.

Don’t wait for the herd to catch on. Research Giant Mining Corp. (CSE: BFG) today, follow its drilling updates, and consult your financial advisor to see if this high-potential junior fits your portfolio. With assays pending and a resource estimate on the horizon, now is the time to get ahead of the curve. Giant Mining isn’t just a stock—it’s a chance to ride the next big wave in copper and gold.

Disclosure Statement

This article contains forward-looking statements regarding the company featured. These statements are based on current expectations and assumptions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied. Readers are cautioned not to place undue reliance on forward-looking statements.

Neither the author nor GEKKOvsWOLF has any business relationship with the company featured in this article. No compensation has been received for the creation, publication, or distribution of this content. This article reflects the personal opinions of the author and is provided for informational purposes only. It does not constitute financial, investment, or legal advice.

Readers are strongly encouraged to perform their own due diligence and consult with a licensed financial advisor before making any investment decisions. Investing in junior resource companies or crypto-related projects involves significant risks, including the potential loss of principal. For comprehensive and up-to-date information, refer to the company’s public filings on SEDAR+, OTC Markets, EDGAR, and other official disclosure sources.