Osisko Development Corp: A Golden Opportunity to Revive Barkerville’s Historic Cariboo Gold Mine

The Cariboo Gold Project, spearheaded by Osisko Development Corp. (TSXV, NYSE: ODV), promises to breathe new life into British Columbia’s historic Barkerville region, a once-thriving gold mining hub that faded into obscurity after its peak in the 19th century. With a recently optimized Feasibility Study released on April 28, 2025, Osisko Development has positioned itself as a compelling investment opportunity in the junior gold sector. The Cariboo Gold Project, fully permitted and backed by a robust financial outlook, could be a game-changer for investors seeking exposure to a high-potential gold asset in a mining-friendly jurisdiction. Let’s dive into why Osisko Development deserves a closer look.

Project Overview: Reviving a Historic Gold Belt

The Cariboo Gold Project, 100%-owned by Osisko Development, is located in central British Columbia within the historic Wells-Barkerville mining camp—a region that produced approximately 4 million ounces of gold during its heyday, equivalent to over $7 billion at today’s prices. The project spans a massive 192,000 hectares, with an 80-kilometer strike length of mineral targets, offering significant exploration upside. Osisko Development acquired the project through its 2019 takeover of Barkerville Gold Mines, a move that consolidated a district-scale opportunity under a management team with a proven track record of building world-class mines, such as the Canadian Malartic in Quebec.

The Cariboo Gold Project is an advanced-stage, feasibility-level underground gold mine. The 2025 Feasibility Study outlines a scalable operation expected to produce 1.87 million ounces of gold over a 12-year mine life. The project received its Environmental Assessment Certificate in October 2023 and an operating permit under the Mines Act in November 2024, marking significant de-risking milestones. Underground development began in Q4 2023, with commercial production under Phase 1 expected by Q4 2024—timelines that position Osisko Development to capitalize on the current gold price environment.

Financial Metrics: A Strong Case for Investment

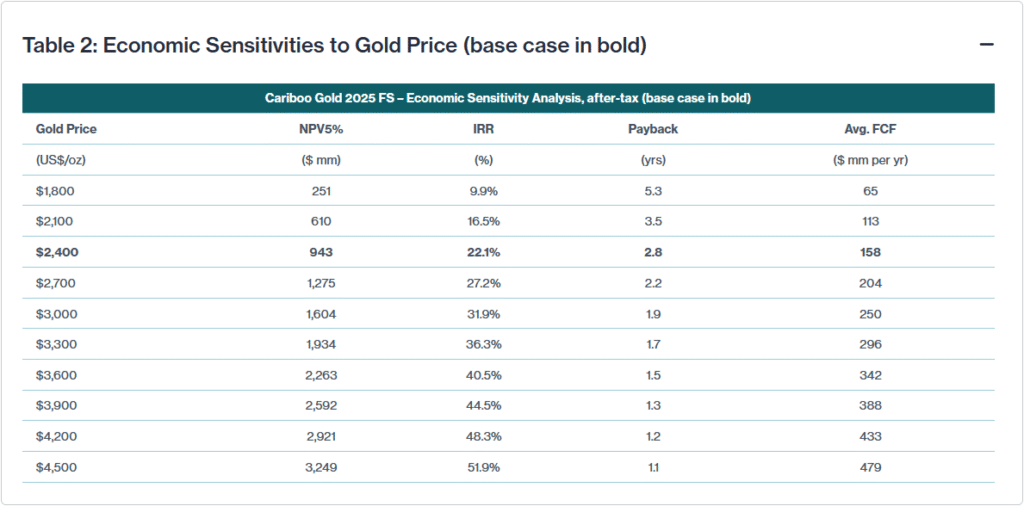

The optimized 2025 Feasibility Study paints an attractive financial picture. At a base case gold price of $2,400 per ounce, the project boasts an after-tax Net Present Value (NPV5%) of C$943 million and an Internal Rate of Return (IRR) of 22.1%. More impressively, at the spot gold price of $3,300 per ounce (as referenced in the study), the after-tax NPV5% soars to C$2.1 billion with a 38.0% IRR. These figures reflect an 88% increase in NPV compared to earlier studies, despite a one-third rise in capital costs, highlighting the project’s sensitivity to gold price movements—a boon in today’s bullish gold market, where prices recently hit an all-time high of $2,748.23 per ounce in October 2024.

Initial capital costs for Phase 1 are estimated at $137 million, with total capital expenditure over the mine’s life projected at $1 billion. The project will employ 634 workers during construction and sustain 500 permanent jobs during operations, generating an annual payroll of $53 million. With proven and probable reserves of 16.7 million tonnes grading 3.7 g/t gold (containing 2.03 million ounces), the Cariboo Gold Project is a sizable asset. Measured and indicated resources (exclusive of reserves) add another 1.57 million ounces, with inferred resources offering further growth potential.

Market Context: Why Gold, Why Now?

Gold is in the midst of a bull market, driven by geopolitical tensions, U.S. election uncertainties, and expectations of monetary easing. As a safe-haven asset, gold’s appeal is undeniable, yet junior gold stocks like Osisko Development often lag behind the metal’s price surge, presenting a buying opportunity. The Cariboo Gold Project’s high-grade deposits—averaging 3.7 g/t gold in reserves—position it to deliver strong margins, especially with gold prices trending above $2,700 per ounce. Additionally, the project’s location in British Columbia, a Tier-1 mining jurisdiction, reduces regulatory and geopolitical risks compared to operations in less stable regions.

Risks and Critical Considerations

While the Cariboo Gold Project offers significant upside, it’s not without risks. Community opposition in Wells, a small town of 220 residents, has been vocal. Local stakeholders, including resident Dave Jorgenson, have raised concerns about the proposed ore-processing concentrator complex—a 12-storey waste rock treatment tower—being built in a residential area. Issues like noise, dust, and light pollution from ore-carrying trucks could impact tourism, a key economic driver for Wells, which benefits from its proximity to the Barkerville National Historic Site. Osisko Development claims to have adjusted plans based on community feedback, but lingering tensions could lead to delays or additional costs.

Capital cost increases also warrant scrutiny. The 2025 Feasibility Study notes a one-third rise in estimated capital costs compared to prior assessments, reflecting inflationary pressures and the complexity of underground mining. While the higher NPV offsets this concern, investors should monitor Osisko’s ability to manage costs as the project progresses. Finally, the project’s timeline—production starting in Q4 2024—assumes no further permitting or construction delays, a potential risk given the scale of the operation.

First Nations Collaboration: A Positive Step

Osisko Development has made strides in building relationships with Indigenous communities, notably the Lhtako Dene Nation (LDN). An agreement signed in October 2020 ensures jobs, training, and contracting opportunities for LDN people, along with financial provisions to enable their participation in the project’s benefits. This collaboration not only mitigates social risks but also aligns with modern ESG (Environmental, Social, Governance) standards, increasingly important for institutional investors.

Why Osisko Development Stands Out

Osisko Development’s management team is a key differentiator. Led by CEO Sean Roosen, the team has a history of successfully developing large-scale gold projects, including Canadian Malartic, one of Canada’s largest open-pit gold mines. This experience instills confidence in their ability to execute the Cariboo Gold Project. Additionally, Osisko’s creation of the North Spirit Discovery Group—a platform to privatize and surface value in resource development projects—signals a strategic vision to unlock further growth opportunities.

The project’s scale and exploration potential also set it apart. With 6 million ounces of gold identified and growing, the Cariboo Gold Project is poised to become Canada’s next big gold belt. Analyst Mickey Fulp of the Mercenary Geologist has called it “the best project in Canada,” citing its high-grade deposits and district-scale potential. Posts on X reflect similar optimism, with users highlighting the project’s strong NPV and IRR as reasons to consider Osisko Development a compelling investment.

Valuation and Investment Thesis

Osisko Development’s current market valuation does not fully reflect the Cariboo Gold Project’s potential. Trading at a discount to its peers in the junior gold space, ODV offers significant upside as the project advances toward production. The stock’s sensitivity to gold prices means that continued strength in the gold market could drive substantial returns. For investors comfortable with the risks of a pre-production miner, Osisko Development presents a rare opportunity to invest in a fully permitted, high-grade gold project with a clear path to production.

Conclusion: A Golden Opportunity Worth Considering

Osisko Development Corp. is on the cusp of reviving Barkerville’s historic Cariboo Gold Mine, with production set to commence in Q4 2024. The project’s strong financial metrics, high-grade deposits, and experienced management team make it a standout in the junior gold sector. While community opposition and capital cost risks require monitoring, the overall risk-reward profile is favorable, particularly in the current gold bull market. Investors seeking exposure to a high-potential gold asset should consider Osisko Development as a core holding in their portfolio.

Disclosure Statement

This article contains forward-looking statements regarding the company featured. These statements are based on current expectations and assumptions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied. Readers are cautioned not to place undue reliance on forward-looking statements.

The author owns shares of the company featured in this article, purchased in the open market. The author and GEKKOvsWOLF have no business relationship with the company and have received no compensation for the creation, publication, or distribution of this content. This article reflects the personal opinion of the author and is provided for informational purposes only. It does not constitute financial, investment, or legal advice.

Readers are strongly encouraged to perform their own due diligence and consult with a licensed financial advisor before making any investment decisions. Investing in junior resource companies or crypto-related projects involves significant risks, including the potential loss of principal. For comprehensive and up-to-date information, refer to the company’s public filings on SEDAR+, OTC Markets, EDGAR, and other official disclosure sources.