Unearthing Value: Why Copper Stocks Are Poised for a 2025 Surge

Copper, often called “Dr. Copper” for its ability to signal economic health, is gearing up for a breakout in 2025. As the world accelerates toward electrification and renewable energy, copper’s role as a critical metal in electric vehicles (EVs), solar panels, and wind turbines has never been more pronounced. With supply constraints looming and demand projected to soar, copper stocks offer a compelling investment opportunity for those looking to capitalize on this mega-trend. Let’s explore why copper stocks, including companies like Doubleview Gold Corp., are poised for a surge in 2025.

The Copper Demand Boom: A Perfect Storm

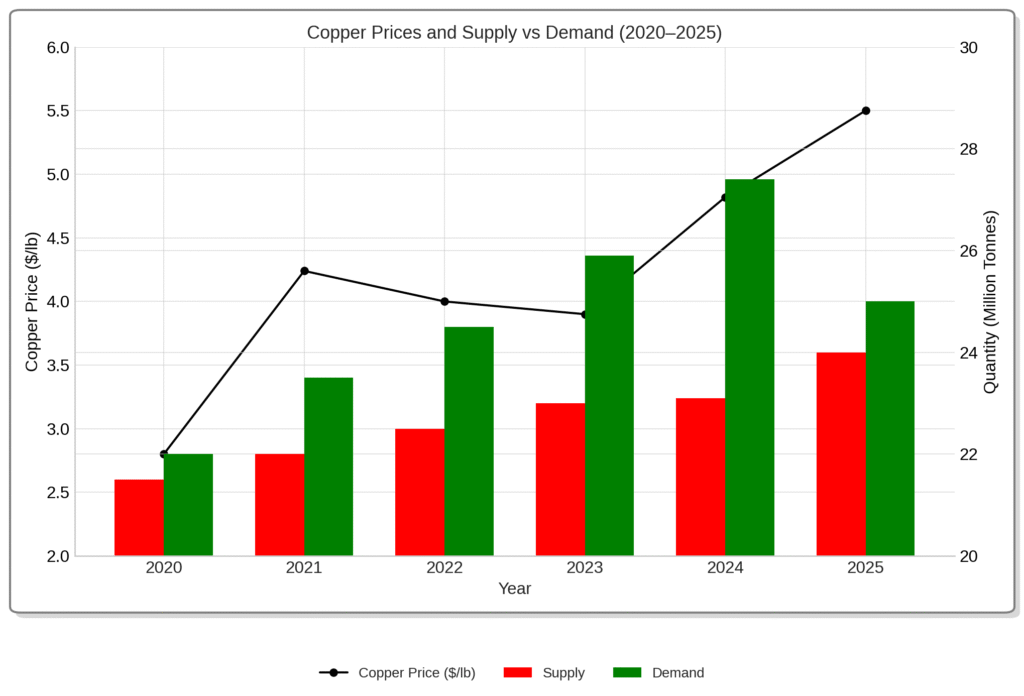

Copper demand is set to skyrocket in 2025, driven by the global push for decarbonization. According to the International Energy Agency (IEA), renewable energy capacity must triple by 2030 to meet net-zero goals, requiring an estimated 4.5 million tonnes of additional copper annually by then. EVs alone use 3-4 times more copper than traditional vehicles—up to 80 kg per car—while a single wind turbine can require 4 tonnes of the metal. With global copper demand expected to reach 25 million tonnes in 2025, up from 22 million tonnes in 2023, the market is facing a structural deficit.

On the supply side, challenges abound. Major copper-producing countries like Chile and Peru are grappling with declining ore grades, labor strikes, and regulatory hurdles. A 2024 report by S&P Global noted that new copper mine production will struggle to keep pace, with a projected supply shortfall of 1 million tonnes by 2025. Meanwhile, existing mines are aging, and new projects face long lead times—often 10-15 years from discovery to production. This supply-demand imbalance has already pushed copper prices to $4.50 per pound in April 2025, up from $3.80 a year ago, with analysts at Goldman Sachs forecasting $5.50 per pound by year-end.

Why Copper Stocks? The Leverage Play

While investing in copper futures or ETFs offers exposure to the metal’s price, copper stocks provide leveraged upside. A 10% increase in copper prices can translate to 20-30% gains for well-positioned copper miners, thanks to operating leverage and margin expansion. Junior miners and exploration companies, in particular, offer outsized returns as they transition from discovery to production, often attracting takeover interest from majors like BHP or Rio Tinto, who are eager to secure future supply.

Doubleview Gold Corp: A Copper Play with Gold & Scandium Upside

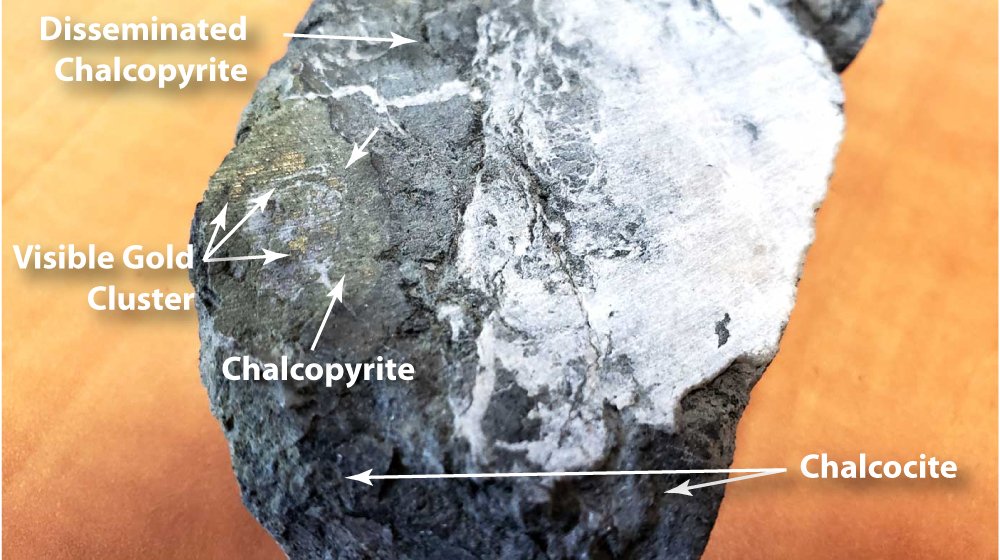

One company that stands out in the copper space is Doubleview Gold Corp. (TSXV: DBG), which offers exposure to both copper and gold through its Hat Deposit in British Columbia, Canada. The Hat Deposit, a porphyry-style project, contains significant copper, gold, and scandium resources—a rare combination that enhances its economic potential. A 2024 resource estimate pegged the deposit at 150 million tonnes of indicated resources grading 0.32% copper, 0.23 g/t gold, and 45 g/t scandium, with inferred resources adding another 50 million tonnes at similar grades.

Doubleview’s strategic location in a Tier-1 jurisdiction like British Columbia minimizes geopolitical risks, while its polymetallic nature provides a hedge against volatility in any single metal. Copper accounts for roughly 60% of the project’s net smelter return (NSR), with gold and scandium contributing the rest. Scandium, a critical metal used in aerospace and clean energy, adds a unique value proposition, as global supply is limited and prices often exceed $1,500 per kg. With ongoing drilling and a Preliminary Economic Assessment (PEA) expected in late 2025, Doubleview is well-positioned to benefit from rising copper prices while offering diversification through gold and scandium.

Macro Tailwinds: Beyond the Green Revolution

Beyond the green energy boom, macroeconomic factors are aligning in copper’s favor. China, the world’s largest copper consumer, is ramping up infrastructure spending to stimulate its economy, with a $1.4 trillion stimulus package announced in March 2025. This will drive demand for copper in construction, power grids, and manufacturing. Meanwhile, the U.S. Federal Reserve’s recent rate cuts—bringing the federal funds rate to 4.25% in April 2025—have weakened the U.S. dollar, making copper more affordable for global buyers and boosting prices.

Geopolitical tensions, including trade disputes and sanctions on Russia (a key copper producer), are further tightening supply. Posts on X highlight growing investor sentiment, with users noting copper’s “perfect storm” of fundamentals. One user wrote, “Copper stocks are the best play for 2025—demand is unstoppable, and supply can’t keep up.” This sentiment aligns with analyst views, as Bank of America recently named copper its top commodity pick for the year.

Risks to Consider: Not a One-Way Bet

Despite the bullish outlook, copper stocks come with risks. Price volatility is a concern, as copper is sensitive to economic slowdowns. If global growth falters—say, due to a deeper-than-expected recession in Europe—demand could soften, pressuring prices. Doubleview, as a pre-production company, faces additional risks, including exploration uncertainties and the need for significant capital to advance the Hat Deposit to production. Permitting delays or community pushback in the British Columbia could also impact timelines.

Why 2025 is the Year for Copper Stocks

The timing for copper stocks couldn’t be better. With production at the Hat Deposit potentially starting by 2027, Doubleview Gold Corp. is an early-stage play that could see significant re-rating as it advances through the PEA and feasibility stages. Larger copper producers like Freeport-McMoRan (NYSE: FCX) and Teck Resources (TSX: TECK) offer more immediate exposure, with established operations and strong balance sheets to weather volatility. However, for investors seeking higher risk-reward, juniors like Doubleview provide the most torque to rising copper prices.

The broader copper sector is also seeing increased M&A activity, as majors look to secure future supply. In 2024, BHP’s $39 billion bid for Anglo American (which includes significant copper assets) fell through, but the appetite for consolidation remains strong. Doubleview, with its high-quality Hat Deposit, could become a takeover target, adding speculative appeal for investors.

Valuation and Investment Thesis

Copper stocks are currently undervalued relative to the metal’s fundamentals. Doubleview Gold Corp., for instance, trades at a market cap of $50 million, a fraction of the Hat Deposit’s potential value once in production. Assuming a copper price of $5.50 per pound and a conservative 5% NSR, the deposit’s copper alone could generate $500 million in revenue over its mine life, not including gold and scandium contributions. This suggests significant upside as Doubleview de-risks the project.

Conclusion: Digging into Copper’s Bright Future

Copper stocks are poised for a 2025 surge, driven by a structural supply-demand imbalance, macro tailwinds, and the global energy transition. Doubleview Gold Corp., with its copper-rich Hat Deposit, offers a unique opportunity to gain exposure to this trend while diversifying through gold and scandium. While risks remain, the potential rewards outweigh the challenges for investors with a long-term horizon. As copper prices climb, companies like Doubleview are ready to unearth significant value—making now the time to dig into this red-hot sector.

Disclosure Statement

This article contains forward-looking statements regarding companies referenced herein. These statements are based on current expectations and assumptions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied. Readers are cautioned not to place undue reliance on forward-looking statements.

The following article was authored by an independent contributor and reflects their personal views. However, an affiliate of this website is a director and/or insider of one of the companies referenced in this article. This relationship may present a potential conflict of interest. GEKKOvsWOLF affiliates may also hold securities of companies discussed and could benefit from share price appreciation. This article is provided for informational purposes only and does not constitute financial, investment, or legal advice.

Readers are strongly encouraged to perform their own due diligence and consult with a licensed financial advisor before making any investment decisions. Investing in junior resource companies or crypto-related projects involves significant risks, including the potential loss of principal. For comprehensive and up-to-date information, refer to each company’s public filings on SEDAR+, OTC Markets, EDGAR, and other official disclosure sources.